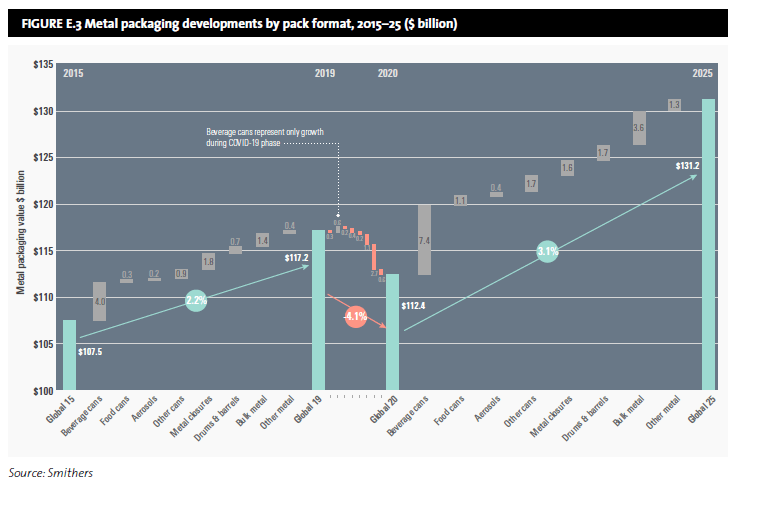

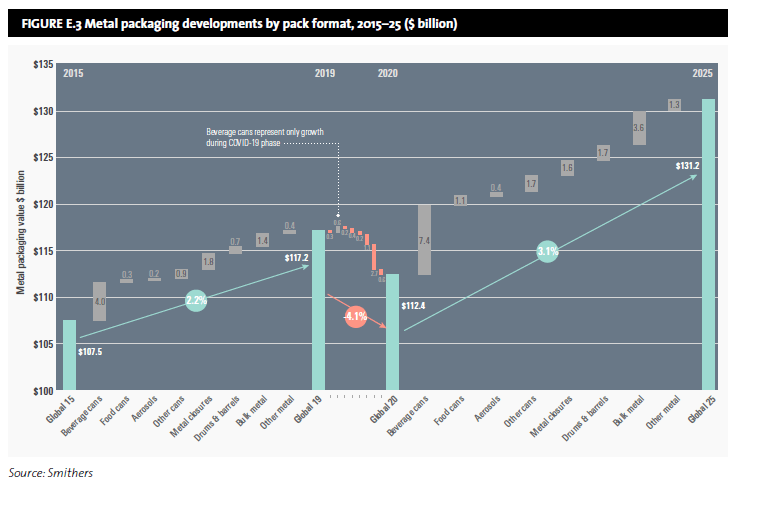

In relation to global population growth, the metal packaging and coatings market continues to be a vital industry, particularly for food and beverage products. Impacted by the coronavirus pandemic this year, the global market will reach $112.4 billion in 2020, representing a fall of $4.8 billion compared to 2019, with the industrial segments hit especially hard. Positive growth will return in 2021, surpassing pre-COVID-19 levels, according to

The Future of Metal Packaging and Coatings to 2025, a new report from Smithers.

The in-depth examination of the sector found that in the pre-COVID-19 world, metal packaging demand had grown at a consistent rate, albeit at a lower level than all other packaging. Overall, metal packaging has seen an increase in demand, most notably in beverage cans. Smithers also found that food packaging is proving to be insulated from COVID-19 and will likely increase in volume everywhere, as people are forced to stay at home and will stock food and drink accordingly.

Impact of the coronavirus

Since the onset of the coronavirus, demand for different metal packaging formats is being impacted differently. Overall, a post-COVID tailwind will raise the 2020-2025 industry compound annual growth rate (CAGR) to 3.1% – almost twice that predicted in pre-pandemic forecasts. This will push worldwide value to $131.2 billion in 2025, at constant prices.

The lockdown in Europe and North America in H1 2020 caused a surge in demand for food cans of around 10%, as consumers stock up on tinned foodstuffs. There has also been a rise in demand for beverage cans as drinkers move away from bars and restaurants to socially distanced home consumption.

In contrast, disruption to international trade is impacting bulk metal containers, fabricated steel boxes, and shipping barrels and drums seriously with 80% of the 2020 demand drop confined to these formats.

Evolution by product type

To provide a more in-depth look, Smithers’ analysis divides the market into five segments -- cans (beverage, food, aerosol, and other cans), metal closures, industrial bulk containers, industrial drums and barrels, and other aluminium containers. The largest sector by value is cans, and in 2019 represented 56% of total value. With beverages accounting for 70% of this by volume, future developments – including for soft drinks, energy drinks and beer – is seeing can makers invest in adding capacity as they enter the 2020s.

Looking at this evolution by product type in Figure E.3, beverage cans is the largest product with 28% of the total metal packaging market value in 2019, and 50% of total cans, having grown $4 billion in value since 2015. Unit volume reached 365 billion cans in 2019 with an annual increase of 2.9%, worth an additional 10 billion or so cans per year. The COVID-19 impact is estimated to be minimal with $0.3 billion contraction followed by an estimated $7.4 billion growth between 2020 and 2025 when the market is estimated to be 446 billion beverage cans – an annual growth rate of 4.2% or an additional 16.5 billion cans per year.

Leading geographical markets

Leading geographical markets

The region with extraordinary growth in metal packaging is developing Asia without Japan (Dev Asia-J), which grew $6.8 billion between 2015 and 2019; this is China and other Asia. The second region for growth was Western Europe with $2.1 billion. The COVID-19 effect is estimated to be greatest in North America and Western Europe with 63% or $3.0 billion of the estimated $4.8 billion COVID-19 contraction, as the pandemic has been worst in those regions. Post-COVID-19 forecast to 2025 estimates that Dev Asia-J should grow $8.5 billion, followed by North America with $3.2 billion, Western Europe with $2.1 billion and South and Central America with $2.0 billion growth. The underlying growth is forecast as 3.2% annually.

Sustainability

Metal packaging performs well in environmental terms due to recycling, but will continue to be examined for further lightweighting opportunities to help meet sustainability targets. Areas of focus for cans are wider use of lower weight can ends, and replacement of three-piece cans with two-piece constructions. In aerosols, weight savings are being enabled by the use of alloy slugs, and there is new interest in bag-on-valve designs for both single and dual-dispensing products.

In congested consumer applications, brands are working to make their packaging distinctive with enhanced decoration. To deliver this, conventional metal packaging print equipment is becoming more feature rich and supplemented by more inkjet installations. These changes allow for more variated and innovative designs, improved matte or glossy finishes, and tactile effects.

In response to pressure from legislators and public health lobbyists, there has been a move away from epoxy phenolic coatings in food cans. Despite the substance being cleared for the application by regulatory authorities in the US and EU, the eventual substitution will potentially extend into less mature economies over the next five years.

Leading geographical markets

Leading geographical markets