Market Report

The Future of 3D Printing to 2027

Cutting-edge technology developments, evolving value chains and market innovations are pushing 3D printing into the mainstream arena according to the latest exclusive research from Smithers

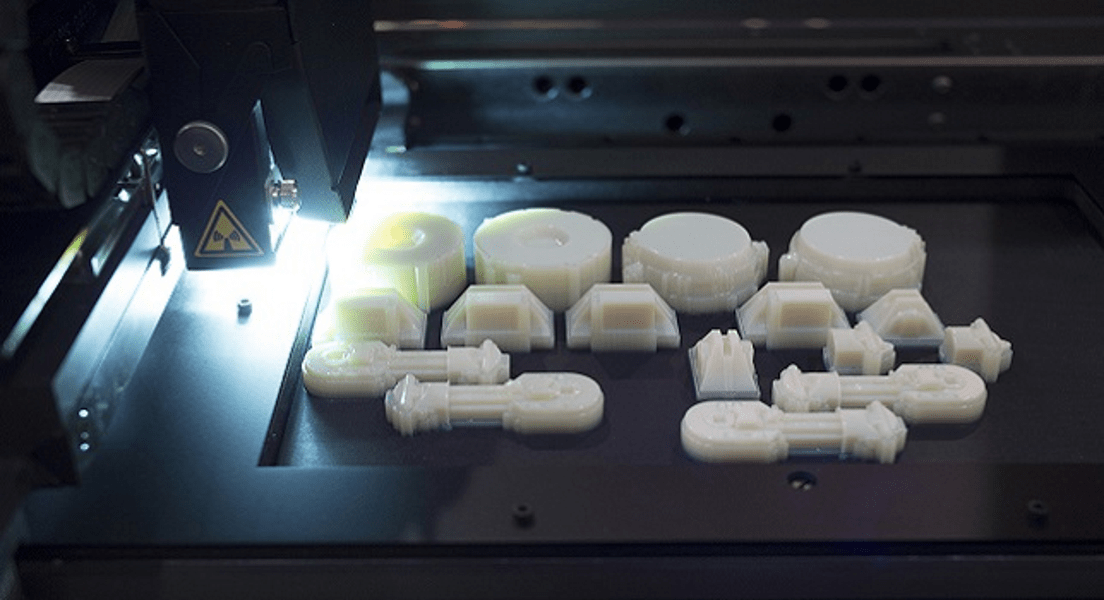

According to the new Smithers report The Future of Global 3D Printing to 2027 this market is set for explosive growth over the next decade. It will rise from $5.8 billion in 2016 to $55.8 billion by 2027, an aggressive annual growth rate of 23.0%. The 3D printing market is beginning to transition into a maturing business environment and has earnt an important position as a design and prototyping tool, and in the production of complex tooling and moulds.

The market continues to experience substantial success among hobbyists and home users, dominating the number of 3D printers delivered in 2016 (233,000 printers versus 63,000 units in industrial/commercial applications), and in the total number of 3D printers installed. However, the combined value of the industrial/commercial sectors is overwhelmingly larger ($5.4 billion versus $0.4 billion in 2016), due to the much higher cost of industrial/commercial 3D print hardware, higher raw materials costs and larger spending on services.

Evolution of printer and materials technologies

The most common 3D printing raw materials are the commodity thermoplastic polymers:

These materials, made in huge quantities by the global chemicals and plastics industry, are readily available, relatively inexpensive, and easy to handle and process in fused filament fabrication (FFF) 3D printing equipment.

Currently, the most readily available metallic raw materials are aluminium and bronze powders, selected grades of maraging steel and of stainless steels, a few aluminium alloys, cobalt-chromium compounds and a limited number of titanium alloys. Private industry and independent research agencies are investing substantial R&D resources to expand the envelope of metals for 3D printing.

The pace of raw materials development for 3D printing will accelerate dramatically over the coming years. Raw materials for 3D printing will become more uniform and of a higher, more reliable quality. These materials will be generally more accessible and affordable, and improvements in materials formulations and processing techniques will make them more user friendly.

With the advancing technology and sophistication of the 3D printing marketplace, value chains are evolving to meet the growing and diverging needs of the rapidly developing markets. Currently, most industrial/commercial 3D printing installations function as a stand-alone unit operation, not intimately integrated into the overall manufacturing environment and workflow. For many companies, 3D printing remains something of a lab curiosity, still far from achieving its potential to transform product design and manufacturing processes or, ultimately, the structure of value chains and the marketplace.

Companies with a deep experience of incorporating 3D printing principles into their design and manufacturing workflow – companies like Airbus, Lockheed Martin, and Boeing – are now developing integrated manufacturing systems that seamlessly incorporate 3D printing into the factory environment and workflow.

The industry will likely devise constructive solutions to potential business transformations. While traditional second tier part suppliers and logistics companies may see their business diminish over time, these changes will open up significant opportunities, particularly for contract manufacturing providers.

Leadership in the global 3D printing marketplace will continue to reside in North America and Western Europe. Asian companies will manufacture an increasingly large share of 3D printing machines, especially the low-cost, lower capability machines favoured by the hobbyist/DIY segments, and by casual school and commercial users.

Widespread innovation is expected across the forecast period, both in terms of 3D printing technologies and equipment, and in terms of raw materials and end uses. Widespread adoption of 3D printing processes will enable the dramatic transformation of value chains and supplier–customer relationships.

Many of these innovations will address the natural evolutionary pressures that affect any new technology: increases in production speeds, process efficiency and reliability, reductions in machinery and systems costs, and improvements in product quality and uniformity.

Smithers exlusive research reveals the industry can expect:

These changes in the scope and direction of 3D printing innovation will create substantial opportunities for the industry in terms of 3D printing materials and processes, applications and end user development; and in terms of the value chains and relationships across the 3D printing business environment.

The full impact of these technology changes, innovations and evolving supply chains are analysed in-depth in Smithers report The Future of 3D Printing to 2027.